Table of Content

- Case Study: Capstone Partners Advises UrbanStems on a $20 Million Series C Growth Capital Raise

- Line of credit home loan

- Can you get a home equity loan without a mortgage?

- HELOCs aren’t interest-only forever

- Differences between HELOCs and home equity loans

- Bankrate

- Benefits of a home equity loan:

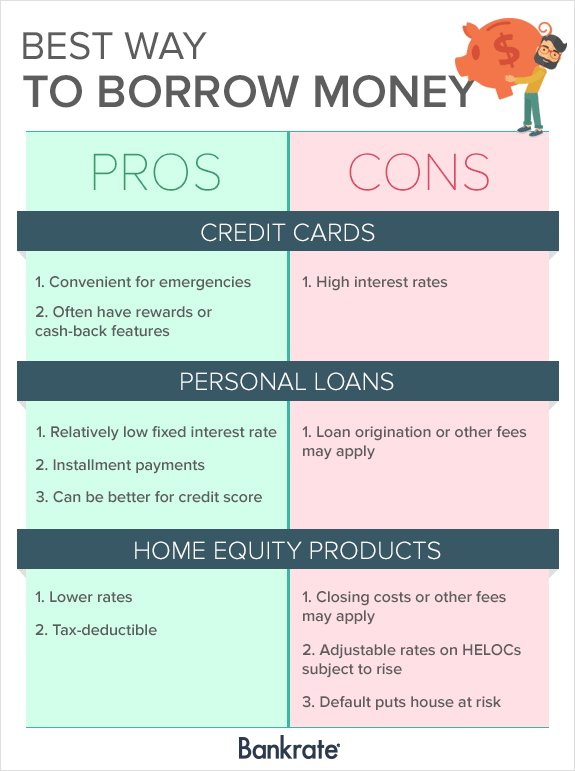

- Alternatives to home equity loans

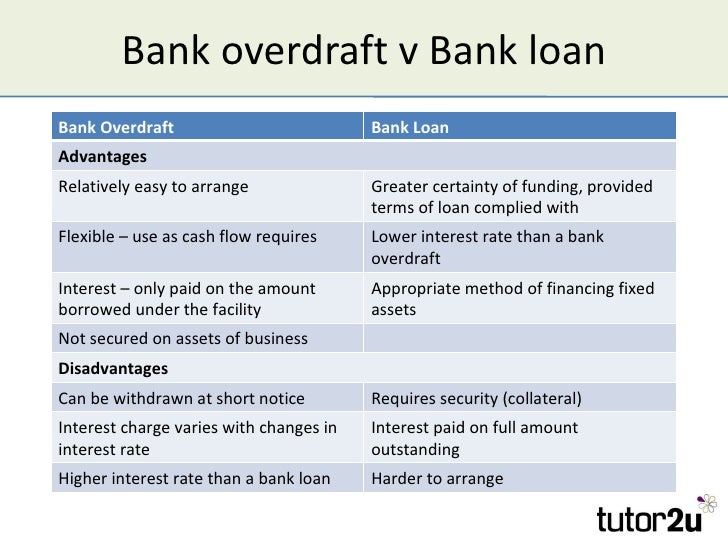

If you wind up needing less cash than you thought, you’ll have a smaller monthly payment. With a HELOC, you can typically borrow up to 85 percent of your home’s value, minus outstanding mortgage payments, which means that these loans won’t work for borrowers who don’t have considerable equity. You also need good credit to qualify, as well as provable income to repay your loan. If you’re a candidate for a HELOC, here are some of the biggest advantages. Low monthly payments – If the title loan payment is more than your budget then refinancing your car title loan can be beneficial.

Home equity is the difference between the debt you owe on your home and the value of your home. According to the Survey of Consumer Finance, 50 percent of the net wealth for most U.S. households is in home equity. Home equity loan interest rates tend to be lower than HELOC rates. Lenders will ask to see your W2s or 1099s and use these to evaluate your ability to repay the loan. A home equity loan can be a powerful tool for making home improvements and other large expenditures; however, there are pros and cons of getting a home equity loan. Learn what you’ll need to qualify under current requirements.

Case Study: Capstone Partners Advises UrbanStems on a $20 Million Series C Growth Capital Raise

If you are struggling to make your scheduled monthly payments, it makes complete sense to consolidate your debt into a single easy-to-make payment to help you save a lot of money in the long run. Personal loans provide a lump sum of cash that can be used for anything. You repay the loan over a set time period with a set interest rate. With a personal loan, you could borrow as little as a couple thousand dollars for two years, or as much as $100,000 for 12 years, depending on what you need and your credit history.

Where home equity loans offer a fixed interest rate that will never change, home equity lines of credit come with variable rates. This means that your rate can go up or down based on the decisions of the Federal Reserve — so even if you take out a HELOC with a low rate, you could face high rates when it comes time to pay. This is especially true in 2022, as the Federal Reserve continues to hike its key rate. The best part about availing of a home equity loan is that the interest rate is usually fixed for the number of years of the repayment of the loan.

Line of credit home loan

Keep in mind that your house is at risk of foreclosure if you can’t pay back your loan. Taking out a home equity loan can bring several advantages and disadvantages. Here is a list of factors you should consider while deciding on taking out a home equity loan.

Always be sure to make payments on time, every time, in the appropriate amounts. Otherwise you will lose your home and end up with nothing in the end. With home equity loans, the interest rate can even go lower than what people pay on credit card bills.

Can you get a home equity loan without a mortgage?

Your application is subject to the Provider’s terms, conditions and criteria. Home fairness loans are normally the nice option while you understand exactly how plenty you will want and for what quantity. But, it is important to be privy to the reality which you’re putting your property up for sale. If the price of your property decreases, it may bring about having to pay greater than the fee of your property is. The borrower is liable for monthly installments which cover the essentials and also the interest.

InfoChoice, its directors, officers and/or Representatives do not have any ownership of any financial or credit products or platform providers that would influence us when we provide general advice. We may receive fees and commissions from product providers for services we provide as detailed below. Refinancing your car title loan can work in your favor and sometimes not. Thus, the above-mentioned advantages and disadvantages of it will help you offer some clarity. It is essential to take the right decision that works in your favor.

Moreover, repaying the title loan Fontana on time can help boost credit. Thus, it is always essential to ignore giving the benefit of doubt to any situation and consider the decision of refinancing your loan thoroughly. This decision can only be taken if you are pros and cons of refinancing your car or title loan.

Our privacy policy describes how your data will be processed. About Us Capstone Partners is among the largest and most active investment banking firms In the United States. A HELOC also offers flexibility in timing the drawdown of your loan amount.

To secure your home equity loan, your lender puts a lien on your property in the same way your original mortgage lender does. This puts you at increased risk of property loss if you don't meet your repayment obligations. A job loss or other bills piling up that cause you to miss first or second mortgage payments can become a serious problem. A cash-out refinance is when a homeowner refinances their mortgage to a new mortgage , and in the process, borrows more money than what is needed to pay off the current mortgage. The first mortgage is paid off and the homeowner gets a lump-sum payout of the extra cash amount at closing. Homeowners who want to take advantage of a new low interest rate and get a large sum of cash for home improvements and other expenses are most likely to see the benefits of a cash-out refinance.

Depending on many different factors, a 70 year old homeowner of a home valued at $500,000 could receive as much as $250,000 in cash. This sum would be repaid when the house is sold, and the amount owed will never exceed the value of the house. Downsizing generates efficient cash out of all the equity you have accumulated to date – without additional interest to be paid or debt. Downsizing is widely considered the most efficient way to get money out of your home.

To help you navigate the complex world of finance, insurance and utilities, we are committed to offering you a free service to help find you the right product to suit your needs. The maximum amount that you can borrow is another vital consideration. Many lenders have relatively low maximum amounts – up to 80% of your property value, while some offer up to 95% if you have enough equity with the addition of Lender’s Mortgage Insurance . Looking for the best home equity loans is different from searching for “regular” mortgages.

If you qualify for a home equity loan, you can use it for any significant expenses such as home renovation, emergency medical bills, or to pay off debt. The amount of the loan a borrower is eligible for is determined by the difference between the home’s market value and the remaining mortgage balance. Credit Union of Southern California provides mortgage refinancing Home Equity Lines of Credit and Home Equity Loans. The answer is in your home, and this is through a home equity loan. Basically like a second mortgage, you use your house as collateral so that you can take on another loan to take care of the big expenses needed to give your family the life they deserve. Learn the ins and outs of a home equity loan vs. a home equity line of credit to decide which option is best for your financial goals.

Benefits of a home equity loan:

Once the Home Equity loan is tapped, there are regular payments to be made, increasing the potential risk of foreclosure. With so much wealth tied to their homes, it is no wonder that seniors are turning to their home equity as a way to supplement their retirement finances. Nor should it be a surprise that there are many different products to help seniors tap their equity. CU SoCal does not provide and is not responsible for the product, service or overall website content available at these sites.

The new title loan or refinanced loan allows you to repay the original title loan while paying the monthly payments for the new title loan. This entire process of refinancing your car loan allows you to save your car or vehicle from being repossessed by the lenders in case you are unable to repay the title loan. This type of loan comes with a fixed monthly payment and a fixed interest rate, and you get a lump sum of money upfront like you do with a home equity loan. The big difference is personal loans are unsecured, so you don’t have to put your home up as collateral.

No comments:

Post a Comment